Google & Nigerian Government Discussing New Subsea Cable

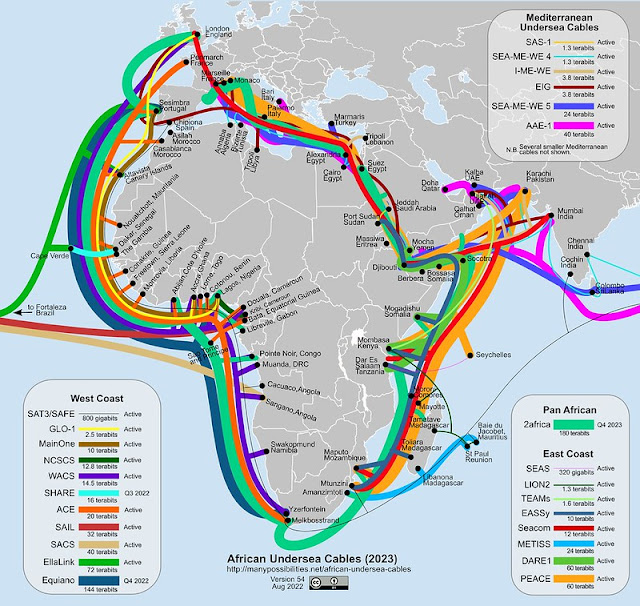

Few details are available at this point. It has been clear to me for some time that the 2Africa and Equiano networks are insufficient to meet growing African Internet traffic. This reflects two factors. First, the limited number of Equiano landings: Togo, Nigeria, Namibia, and South Africa. Secondly, the 2Africa has only 180 Tbps of capacity, but serves 17 African states. Moreover, it also serves many Middle East countries, Pakistan, and India. The Nigerian government is concerned that the country lacks subsea resiliency. Published reports hint at its desire for a new route, but it is not obvious what it would be. One possibility is a direct US-Nigeria link perhaps connecting Atlanta or Ashburn Equinix to Lagos. Or perhaps a Nigeria to France or Spain direct link. Bloomberg article on subject: https://www.bloomberg.com/news/articles/2025-12-23/nigeria-in-advanced-talks-with-google-for-new-undersea-cable.